You can access the distribution details by navigating to My pre-printed books > Distribution

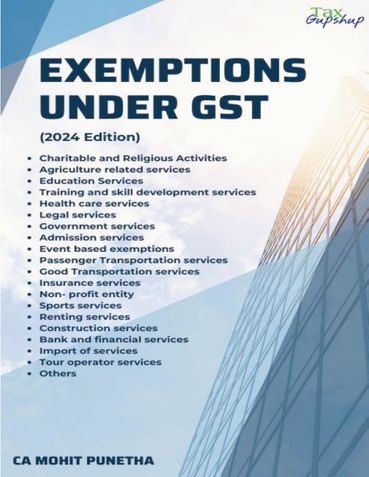

Exemptions under GST (eBook)

Details of various exemptions under GST, benefical for CA, Advocates, Professional Accountants

Description

Definition of exempt supply under GST 1

Power to grant exemptions (Sec 11 of CGST Act 2017) 1

Relevant Notifications

Exemption in GST

Chapter 1–Charitable and Religious Activities

Chapter 2 – Agriculture related services

Chapter 3 – Education Services

Chapter 4- Training and skill development services

Chapter 5– Health care services

Chapter 6 – Legal services

Chapter 7–Government services

Chapter 8-Admissionservices

Chapter 9–Event based exemptions

Chapter 10 – Passenger Transportation services

Chapter 11- Good Transportation services

Chapter 12–Insurance services

Chapter 13–Non- profit entity

Chapter 14–Sports services

Chapter 15 –Renting services

Chapter 16 –Constructionservices

Chapter 17 –Banking and financial services

Chapter 18 –Import of services

Chapter 19 –Tour operator services

Chapter20 - Others

Chapter 21 - Frequently asked questions (FAQ’s)

About the Author

Book Details

Ratings & Reviews

Currently there are no reviews available for this book.

Be the first one to write a review for the book Exemptions under GST.

Other Books in Law, Education & Language

विंग कमांडर शशिकांत ओक

Ashwini Kumar Aggarwal

Pranesh Prakash, Nagla Rizk, Carlos Affonso Souza

Dr. Hitendrakumar M. Patel