You can access the distribution details by navigating to My Print Books(POD) > Distribution

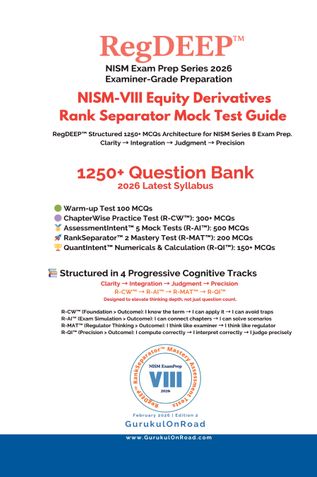

NISM-VIII Equity Derivatives Rank Separator Mock Test Guide 2026

RegDEEP™ Structured 1250+ MCQs Architecture for NISM Series 8 Exam Prep: Clarity → Integration → Judgment → Precision

Gurukul On RoadDescription

NISM-VIII: Equity Derivatives Rank Separator Mock Test Guide 2026. A RegDEEP™ Structured 1250+ MCQs Architecture for NISM Series 8 Exam Prep: Clarity → Control → Integration → Risk Framing → Regulator Thinking → Precision. A RegDEEP™ 2026 Structured MCQs Architecture for NISM Series 8 Exam Prep. It’s a regulator-aligned mock test system designed specifically for NISM-Series-VIII. It moves beyond rote practice to build structured reasoning in hedging, clearing, margining, settlement, and risk management. 1250+ MCQs spread across 4 Progressive Cognitive Tracks, 1. ChapterWise (R-CW™, 300+ MCQs), 2. AssessmentIntent™ Exam Simulation 5 Mock Test (R-AI™, 500 MCQs), 3. RankSeparator™ Mastery Assessment (R-MAT™, 200+ MCQs), and 4. QuantIntent Precision Numericals Track (R-QI™, 150+ MCQs). From concept clarity to regulator-grade judgment, this series trains you to think like the examiner- not just answer questions.

Most mock test books prepare you to attempt questions. This one prepares you to think like the examiner.

The RegDEEP™ Equity Derivatives Mastery Series is not a conventional MCQ compilation. It is a regulator-aligned cognitive training system designed specifically for NISM-Series-VIII: Equity Derivatives Certification Examination. Built strictly around the 2026 official syllabus and test objectives, this series converts complex derivatives concepts - hedging, arbitrage, clearing, margining, settlement mechanics, SPAN, interoperability, delivery margins, position limits, regulatory compliance - into a structured 4-level progression that mirrors how the actual exam tests candidates. This is not about solving random questions. It is about developing layered reasoning under exam pressure.

Structured in 4 Progressive Cognitive Tracks

1. R-CW™ (Foundation Track): Recall → Application → Traps → Unit mastery

Builds absolute clarity in definitions, payoff logic, settlement mechanics, and margin fundamentals. You master terminology, avoid “easy mark losses,” and eliminate conceptual confusion.

Outcome: I know the term → I can apply it → I can avoid traps

2. R-AI™ (Exam Simulation Track): Cross-unit → Concept linking → Decision simulation → Judgment

Integrates multiple chapters in structured caselets. You learn to connect portfolio beta with index futures, delivery margins with ITM options, clearing obligations with margin shortfalls - just like the real exam expects.

Outcome: I can connect chapters → I can solve scenarios

3. R-MAT™ (Rank Separator Track): Multi-layer logic → Bias traps → Regulator Intent Framing

Advanced structural reasoning. You analyze clearing member obligation tables, default waterfalls, proprietary vs client segregation, interoperability margin impact, and regulator intent framing. This level separates passers from rankers.

Outcome: I think like examiner → I think like regulator

4. R-QI™ (Precision Numericals Track): Formula → Application → Interpretation → Judgment

High-probability numerical zone

Outcome: I compute correctly → I interpret correctly → I judge precisely

Designed for Serious Candidates

This book is for:

1. Associated persons functioning as Approved Users of a Trading Member in the Equity Derivatives segment

2. Sales personnel engaged in marketing, advising, or dealing in equity derivative products

3. Individuals operating within the Equity Derivatives segment of a recognized stock exchange

4. Professionals directly involved in execution, client handling, or derivative trading operations

5. First-time candidates who want structured clarity

6. Repeat candidates who lost marks in tricky settlement or margin questions

7. Professionals working in broking, clearing, risk management or compliance

8. Anyone who wants to move from trader-thinking to regulator-thinking

What Makes This Series Different?

Most exam guides focus on memory. The NISM derivatives exam tests structure, sequencing, and risk logic. This mastery system is built around:

SPAN and 99% VaR logic

One-day vs two-day margin horizon interpretation

Gross client margin vs net proprietary margin traps

Delivery margin staging and expiry sequencing

Clearing corporation default waterfall logic

Interoperability capital efficiency framing

Regulatory updates and circular-based nuance

About the Author

Book Details

Ratings & Reviews

Currently there are no reviews available for this book.

Be the first one to write a review for the book NISM-VIII Equity Derivatives Rank Separator Mock Test Guide 2026.

Other Books in Exam Preparation

Biswanath Parida

HARDEEP SINGH

EKTA PRAKASH

THAKUR